As you can imagine, having your travel canceled, interrupted or simply not go as planned is never ideal. When you have travel insurance, however, you can feel better knowing that at least some of your travel expenses will be reimbursed. Hurricane season starts one month from today, and after last’s year’s record storms, many are ensuring they are covered if something does arise this year. This brings light making sure you have your home insurance up to date too just in case a storm does come and you are away from your home whilst it is being damaged. You need to review your insurance policy to see if there is anything that needs to be changed so you are fully covered. Check on your declaration to see what exactly you are covered with, you can also view other declarations to know what you are looking for, you can click to view the page from Simply Insurance who have laid it out clearly.

But what if you file your claim, and it comes back denied?

Stan Sandberg, travel expert and co-Founder of TravelInsurance.com, is a respected authority on travel insurance in the U.S. has provided some information below on reasons a claim could be denied, and how to ensure it isn’t. Given tropical storms could start hitting as soon as next month, having this knowledge could hopefully come in handy when, not if, storms affect travel this year.

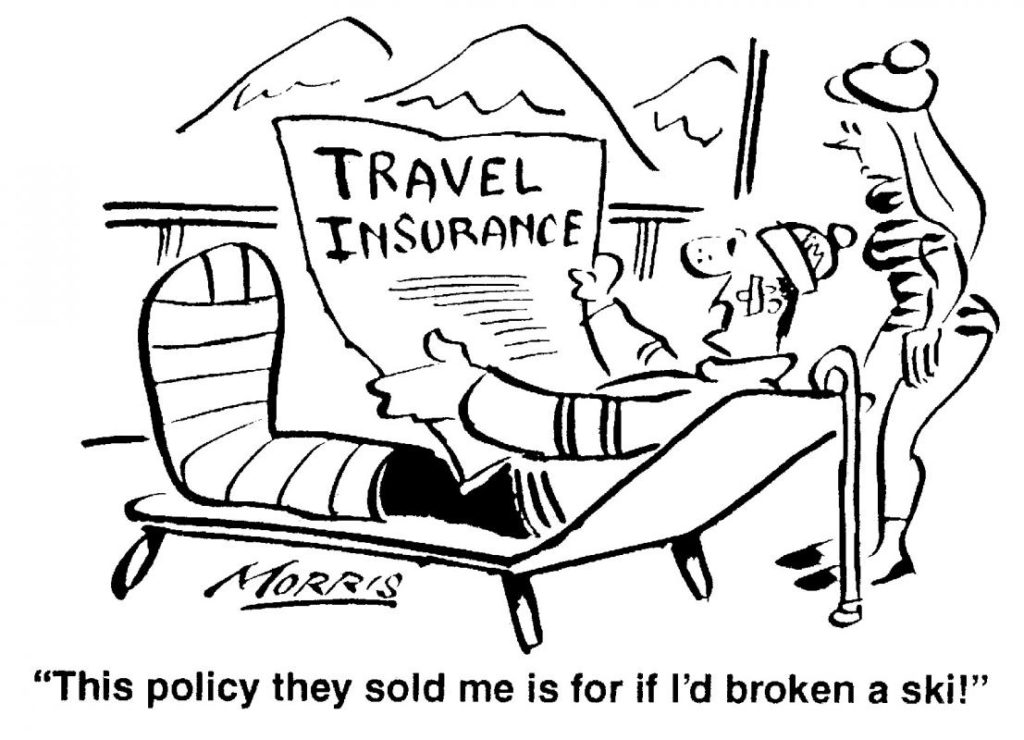

You didn’t purchase the right kind of insurance for your needs: A common mistake that those filing claims make is not taking the time to fully understand their travel insurance policy and the coverage that it provides, before making the purchase. For example, if a traveler is going heli-skiing and gets injured. If he or she did not purchase Adventure Travel coverage, the medical expenses likely won’t be covered. Many travelers submit claims for coverage that they do not even have because they assume that travel insurance will cover just about anything.

Take the time to read your policy, and if you haven’t purchased one yet, look at a few quotes online to get a general idea of how travel insurance works. If you need to submit a claim, a solid understanding of your policy will be the best tool at your disposal. Most policies will have glossaries of the terms, or you can review one online. Click here for the one on TravelInsurance.com.

You misunderstand what is needed when submitting: Some travelers may think they understand everything they need to submit when filing a claim, but they may miss important details. This can hold things up at best, or cause the claim to be denied altogether.

We recommend always calling the insurance company prior to submitting a claim. Read up on your plan so you have a basic understanding. From there, you can ask what documents are needed specifically, the correct steps to file a claim and the best route to send in the claim. The process is usually straightforward for filling out forms and submitting them with the right documentation, but the more complete everything is, the faster the claim will be filed and the payments made.

You failed to provide proof: Documentation is key when it comes to receiving a payout for covered situations. Even if travelers are fully entitled to the benefits of a travel insurance claim, they can wind up with a claim denial if they do not provide the documentation to back their claim up. An insurer will want proof of a trip delay, cancellation or event that causes a policyholder to file a claim, along with receipts that pertain to the purchases made.

You failed to provide proof: Documentation is key when it comes to receiving a payout for covered situations. Even if travelers are fully entitled to the benefits of a travel insurance claim, they can wind up with a claim denial if they do not provide the documentation to back their claim up. An insurer will want proof of a trip delay, cancellation or event that causes a policyholder to file a claim, along with receipts that pertain to the purchases made.

Before anything goes wrong, it is always important to keep track of your purchases related to your trip — receipts and credit card statements showing that you actually paid for the flights, hotels and other trip-related costs that you are claiming against. When you submit your claim, make sure you have all the documentation you can think of. For instance, for ticket compensation, you will need to produce receipts for the tickets. For lost luggage, you will have to provide the list of items inside the luggage as well and so on. Without this information, the insurer has no way to verify that you actually paid for the trip costs. If you are filing a claim for a stolen personal effect during your travels, you should make sure to save the documentation provided by the local police (when you reported the theft) so the insurer can validate that the event actually happened. You might also want to take pictures of all of the items you are bringing on your trip just before you pack them.

You waited too long: Most insurance providers require consumers to file a claim within a specific period from the event of loss. Some insurance providers may offer a period of a few weeks while others may offer a period of one month to file a claim.

Travelers should review their policy or call the insurance company to know about the exact period. If a claim is filed after the due date, most insurance providers will reject the application without any consideration. Most modern travel insurance companies have websites that allow claims to be digitally submitted and processed. This is a great way to get the process rolling and helps save time to meet the deadlines.

You take no for a final answer: Travel insurance claims usually take a few weeks to process. However, complicated claims take longer. For some, if their claim is denied they may fume, but do little to change the outcome.

If your claim is denied, contact the company or agent that sold you the travel insurance plan right away. They will often help with filing an appeal. The good news is that about 50 percent of appeals are honored, so taking this extra step is not a wasted effort, especially if you feel strongly that your claim is valid. When a company will not honor an appeal, the next step is to contact the state insurance commissioner and the Better Business Bureau and see if they can assist.

~ By guest blogger, Sarah Mann